10 Examples of Mortgage-Backed Securities

Mortgage-backed securities (MBS) are integral to the world of finance. These securities, based on a pool of home loans, have been the cornerstone for many institutional investment strategies. This post aims to highlight 10 examples of mortgage-backed securities to provide a better understanding of this complex yet essential financial instrument.

What Are Mortgage-Backed Securities?

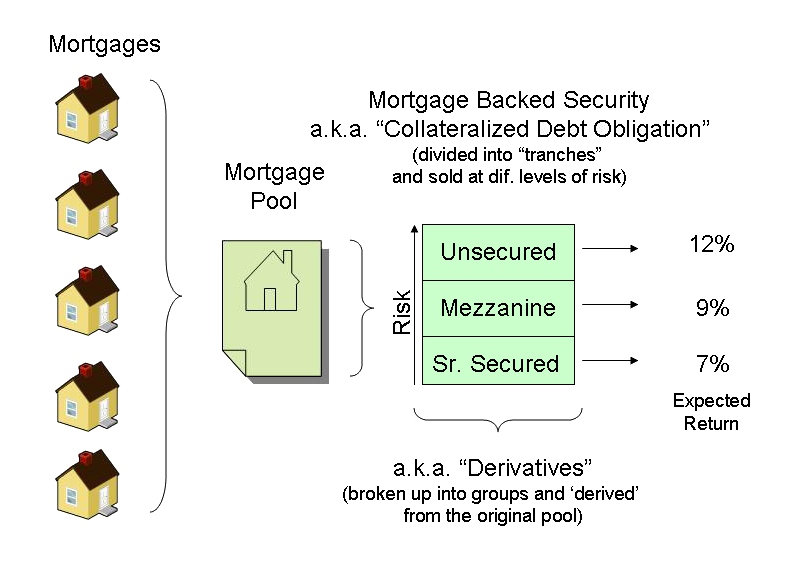

Before diving into the examples, let’s clarify what mortgage-backed securities are. MBS are financial instruments secured by a mortgage or collection of mortgages. These securities allow home loans originated by banks to be grouped together and sold to investors.

Examples of Mortgage-Backed Securities

Let’s delve into the specifics with some examples that illustrate the diversity and versatility of these financial instruments.

1. Government National Mortgage Association (Ginnie Mae)

Ginnie Mae securities are backed by the full faith and credit of the U.S. government. These are often used as components in retirement portfolios due to their stability and government backing.

2. Federal Home Loan Mortgage Corporation (Freddie Mac)

Freddie Mac issues mortgage-backed securities known as participation certificates (PCs). These are composed of conventional mortgages.

3. Federal National Mortgage Association (Fannie Mae)

Fannie Mae issues MBS to expand the secondary mortgage market. These securities help increase the supply of money available for housing.

4. Collateralized Mortgage Obligations (CMOs)

CMOs are a type of mortgage security with different maturity and risk classes. These classes, or tranches, allow investors to choose the risk level they are comfortable with.

5. Commercial Mortgage-Backed Securities (CMBS)

CMBS are backed by commercial mortgages on real estate such as shopping centers or office buildings, rather than residential properties.

6. Stripped Mortgage-Backed Securities

These MBS are split into two categories: principal-only (PO) and interest-only (IO) securities, allowing investors to bet on interest rates and prepayments.

7. Adjustable-Rate Mortgage Securities (ARMS)

ARMs are backed by mortgages with interest rates that adjust over time based on market conditions.

8. Non-Agency Mortgage-Backed Securities

These are issued by financial institutions and other entities, without guarantees from government-sponsored entities.

9. Private Label Mortgage-Backed Securities

Issued by private financial companies, these securities are composed of mortgages that don’t conform to standards set by government-sponsored entities.

10. Whole Loan Securities

These are a type of MBS where each security is backed by a single loan rather than a pool of loans.

People Also Ask

Are Mortgage-Backed Securities a Good Investment?

Mortgage-backed securities can be a good investment for those seeking income over time. However, like all investments, they come with risk. It’s essential to understand these risks and consider your risk tolerance before investing.

What Happened to Mortgage-Backed Securities in 2008?

In 2008, the value of many MBS dropped due to increasing mortgage delinquencies and foreclosures, contributing to the global financial crisis.

How Does a Mortgage-Backed Security Work?

Banks sell mortgages to entities like Fannie Mae. These entities then group the mortgages into securities, which are sold to investors. The investors earn income from mortgage payments.

Conclusion

Understanding mortgage-backed securities and their different types can provide insight into how the housing market, lending practices, and investor behavior influence the broader financial system. While these securities offer attractive benefits, investors should also be aware of the associated risks.

Investors need to consider the risk level, the state of the overall economy, and their individual investment goals before adding mortgage-backed securities to their portfolios. With the right knowledge and due diligence, these securities can become a viable part of a diverse investment strategy.

See also: TOP 10 Best Mortgage Companies for Refinancing